Year End Giving

December 17 - 31 2025 | New Hope Church

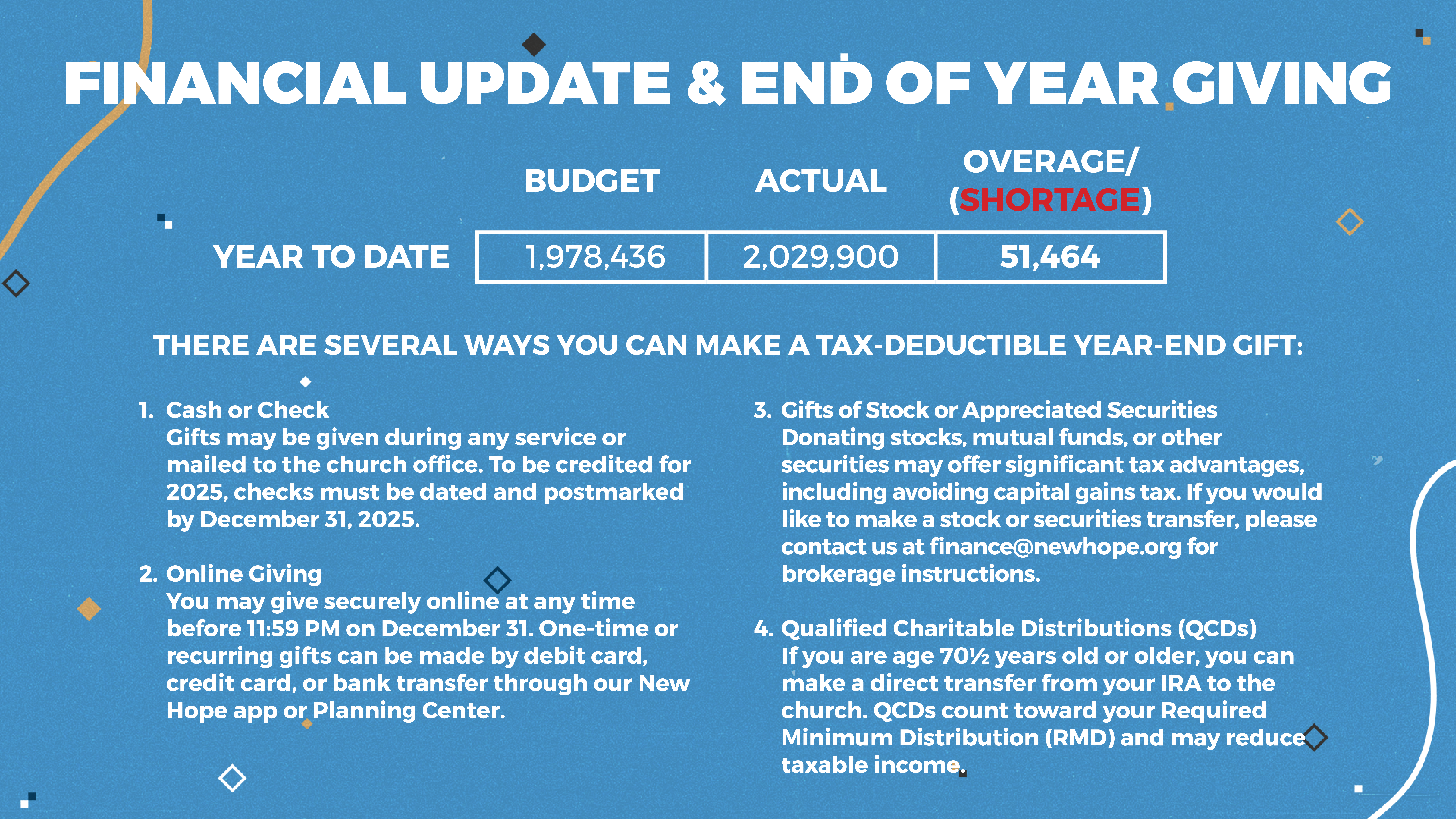

There are several ways you can make a tax-deductible year-end gift:

Cash or Check: Gifts may be given during any service or mailed to the church office. To be credited for 2025, checks must be dated and postmarked by December 31, 2025.

Online Giving: You may give securely online at any time before 11:59 PM on December 31. One-time or recurring gifts can be made by debit card, credit card, or bank transfer through our New Hope app or Planning Center.

Gifts of Stock or Appreciated Securities: Donating stocks, mutual funds, or other securities may offer significant tax advantages, including avoiding capital gains tax. If you would like to make a stock or securities transfer, please contact us at finance@newhope.org for brokerage instructions.

Qualified Charitable Distributions (QCDs): If you are age 70½ years old or older, you can make a direct transfer from your IRA to the church. QCDs count toward your Required Minimum Distribution (RMD) and may reduce taxable income. please contact us at finance@newhope.org for more information.